As an Account Strategist who works with fintech brands, I can tell you that times are a little tough for fintech these days. We saw fintech funding fall in 2022 — a 64% decrease year-over-year since the industry high in 2020 (CBINSIGHTS). The current market correction is forcing fintech brands to think smarter in order to keep growing in today’s market.

One thing I’ve noticed in the past year is a lot of shakeup within internal fintech marketing teams. As a result, team members need to get up to speed — fast — on the latest trends in fintech digital marketing. They also need help understanding and proving the value of digital marketing in general during a time of belt-tightening.

That’s what inspired me to write this guide to the fundamentals of starting a fintech digital marketing program. It will give both new and more established brands a way to break the process down into manageable steps — and rise above both the competition and the funding squeeze.

Here are 8 steps to getting started on your fintech digital marketing strategy:

1. Know your audience — and your competition.

You probably know quite a bit about your audience and your competition already. But it’s well worth your time to create in-depth audience or buyer personas and to conduct structured competitor analysis. Here’s how:

Fintech Buyer Personas

A buyer persona is a semi-fictionalized representation of a particular customer archetype. To create personas, you need to:

- Identify which customer archetypes you need personas for.

- Create questionnaires that cover everything you need to know about your buyers.

- Interview real people in your archetypal roles.

- Summarize your findings in a shareable document.

Done right, you should be able to use your personas to inform pretty much every aspect of your digital marketing strategy.

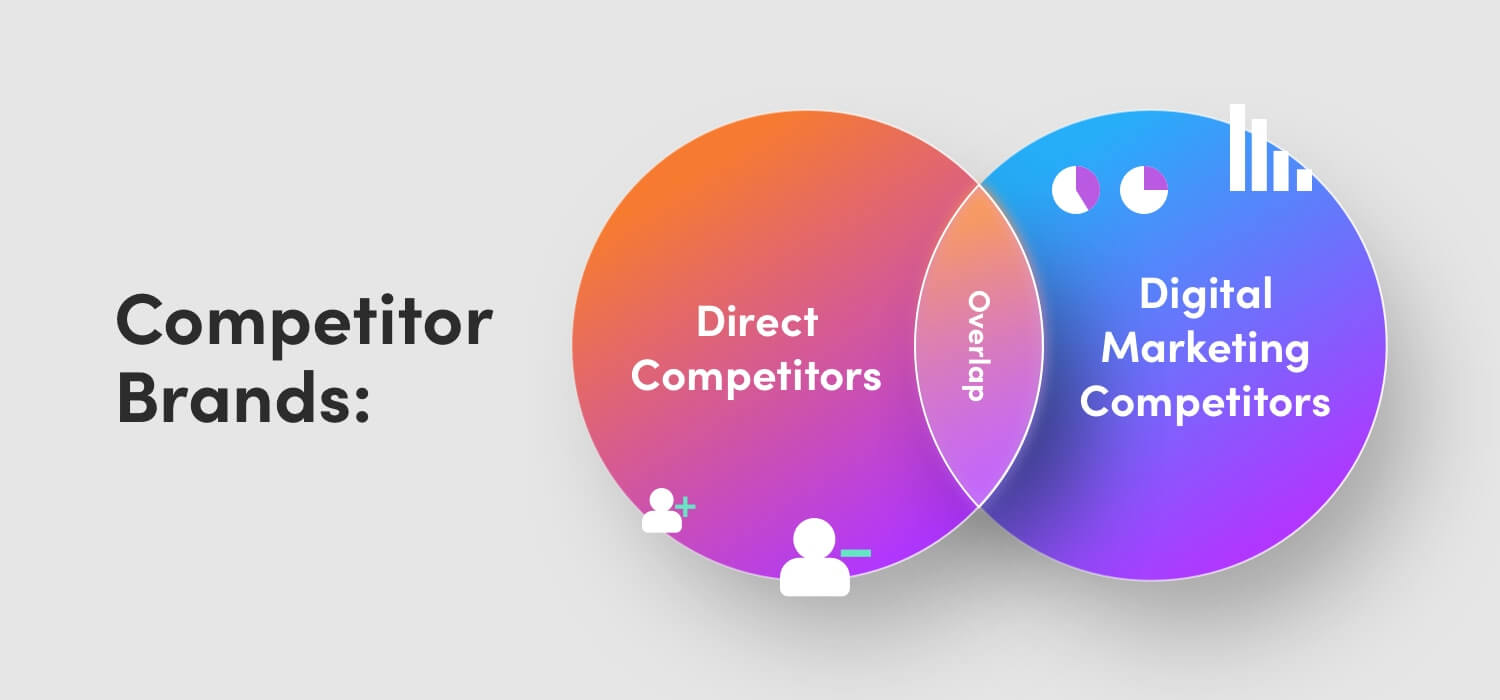

Fintech Competitive Analysis

In digital marketing, we look at competitors through a unique lens. There are two main categories of competitors we’re interested in:

- Direct competitors. These are the fintech brands your customers compare against yours. You’re either losing customers to these brands, or they’re losing customers to you.

- Digital marketing competitors. There will be some overlap with your direct competitors, but the idea here is that we look at who you’re competing against for things like PPC keywords and search engine results page (SERP) rankings.

Both types of competitors are important, but we take a different approach to our research depending on which category we’re looking at. As a general rule, in evaluating direct competitors we look at less technical things like their brand positioning and messaging. For your digital marketing competitors, we use tech tools to uncover their SEO and PPC strategies.

The combination of the two lets us create a comprehensive digital marketing strategy that will help your brand win in a head-to-head messaging face-off and in a competitive PPC bid or SEO play.

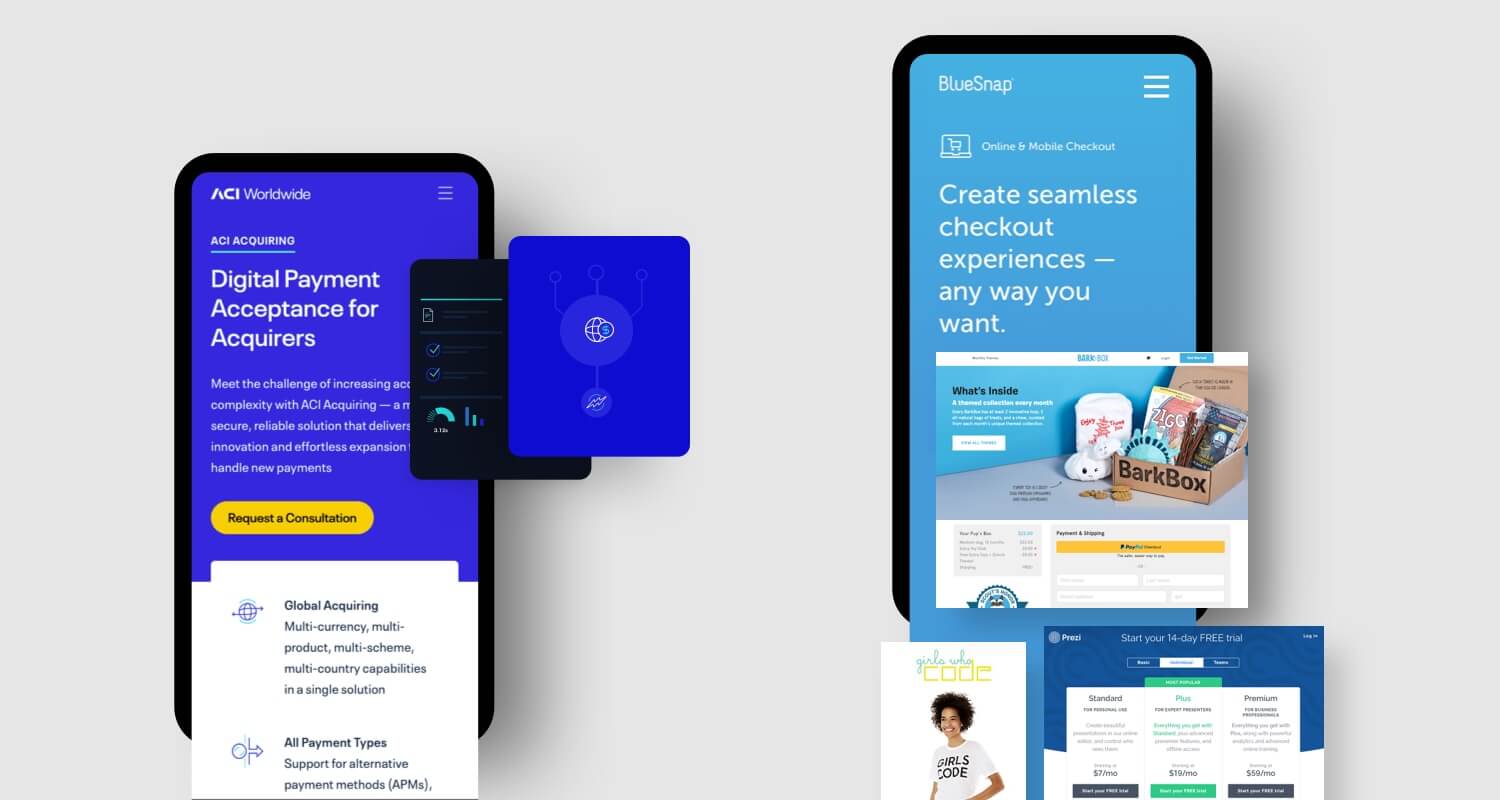

2. Build a strong, engaging brand.

Real talk: the fintech industry is filled with boring, uninspired attempts at branding. This is doubly true for B2B brands that are selling to banks, insurance companies, and other financial service sectors known for their conservative approach to branding.

The process of defining your brand is too in-depth to get into in this post. But a few rules of fintech brand strategy can point you in the right direction.

- Make it simple. Distill your value proposition down to its most impactful, easy to understand form.

- Make it relevant. Use language your customers actually use to talk about their pain points and goals.

- Make it different. Your brand should look, sound, and feel unique. Everything about your brand should reinforce your differentiating value.

- Make it memorable. Shoot for a logo your customers will be able to sketch on a napkin after seeing it a few times. Similarly, make sure your messaging is catchy enough to be remembered — and repeated. (After all, word of mouth is still the best form of marketing out there.)

One of the big questions to ask yourself when you’re building your fintech brand is: which comes first, the visual identity or the messaging?

It’s a trick question, of course — the two aspects of your brand should be developed in lockstep, so they reinforce one another. That being said, you will need to define some aspects of your messaging strategy before you move on to visual branding.

To learn more, read our post on Maximizing Your Brand’s Impact With Messaging Guidelines.

3. Make your website the foundation of your digital marketing strategy.

At Vital, we like to say that we build “beautiful sites that work.” That means the sites we build do more than just inform and educate visitors. They also do all this:

- Drive traffic through Search Engine Optimization (SEO) best practices

- Drive conversions through Conversion Rate Optimization (CRO) strategies

- Build your funnel through our unique approach to content marketing

- Generate leads through a variety of tactics, including premium content offers, chatbot functionality, innovative form design, and more

- Increase sales either directly through eCommerce or indirectly through increasing your Sales Qualified Leads (SQLs)

At a minimum, your website should be easy to maintain and update, include plenty of lead-generation features, and give you visibility into your users’ activities so you can evaluate what’s working and what needs improvement.

For a look at how a website redesign changed the digital marketing game for one of our fintech clients, check out this case study.

A word about mobile-first design for fintech

According to Statcounter, about 60% of all web traffic comes from mobile devices as of October 2022. What’s more, 9 out of 10 people access the internet through their mobile devices at least part of the time.

If your website isn’t mobile friendly, you are losing a huge amount of potential visitors.

That may not be news to you, but in reality there is a huge range when it comes to mobile usability. You can break down the complexity by sorting mobile sites into three categories:

- Mobile responsive sites. These sites are designed for desktop viewing, but the layout and content will automatically adapt to smaller screens.

- Mobile adaptive sites. These sites are built specifically for mobile use, with a totally separate version of the site for desktop users.

- Mobile-first sites. Mobile-first design refers to the practice of designing a site for the smallest screen first, then scaling it up for desktop use.

At Vital, we design mobile first because it leads to the best mobile user experience, and it forces us to break down a site into its most essential elements, which informs our overall approach to UX/UI design.

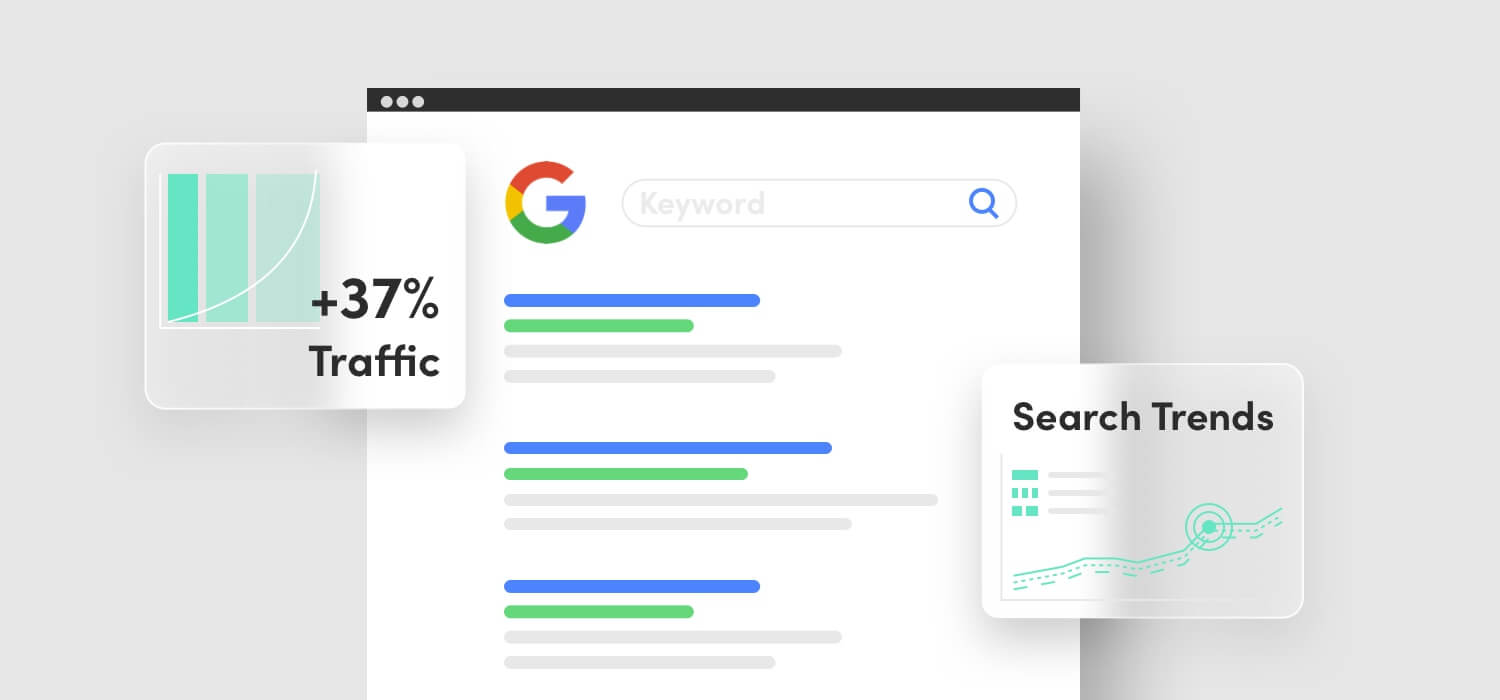

4. Develop your Search Engine Optimization (SEO) strategy.

If I had to sum up the fintech SEO landscape in one word it would be competitive. Give me a few more words and I’d say SEO for fintech is insanely, uniquely, outrageously competitive.

Why is SEO for fintech so competitive?

Fintech SEO is competitive because the major players are established, authoritative, and prolific. It is extremely difficult to rank for fintech-related keywords when the competition is constantly publishing content with a high Expertise, Authority, and Trustworthiness (E-A-T) score.

Think back to when we discussed the difference between your direct competitors and your digital marketing competitors. In this case, we care about a specific slice of your digital marketing competition: those that are targeting (and ranking for) the same set of keywords you want to rank for.

In fintech, you’re going up against huge consulting firms that are dominating the search landscape and driving trends with thought leadership content. You’re also competing with implementation partners, software companies, and industry publications that are gobbling up fintech-related keywords.

But all is not lost!

At Vital, we’ve been able to outpace competitors much larger than our fintech clients through SEO. We do this through a combination of:

- Keyword planning that focuses on searcher intent

- Targeting both short- and long-tail keywords

- Competitor analysis

- Content planning and creation

- Off-page and technical SEO

To learn more, check out our post on SEO for Fintech.

5. Integrate your paid search and social (PPC) strategy.

Just like SEO, paid digital advertising or Pay-per-Click (PPC) for fintech is a competitive (and potentially expensive) game. It’s also where taking a holistic approach to digital marketing starts to pay off.

Look at it like this:

When you manage PPC campaigns, you accumulate a huge amount of data about your audience.

- Which keywords drive the most clicks?

- Which headlines and ad creative are most effective?

- Which offers are most compelling?

- Which aspect of landing page design drives the most conversions?

And so on. You can apply that data-driven intelligence to your SEO strategy, your content marketing, and your conversion rate optimization (CRO) strategy. Those efforts produce their own data that you can re-apply to PPC to drive down your cost per click and cost per conversion.

As an example, Vital was able to drive down the cost per marketing qualified lead (MQL) for one fintech client by 62.5% over only five months of optimizing paid ads. Another fintech client has seen the ROI on their PPC spend increase by over 300% in terms of actual revenue generated.

Learn more about our approach to PPC Marketing here.

6. Create a content marketing plan that’s in tune with your audience.

If I had to name one pillar of digital marketing that fintech companies struggle with the most, it’s content marketing. That’s because many fintech companies are laser-focused on product innovation, development, and go-to-market strategies.

Those are great things to focus on. You won’t succeed in the fintech market without them. But unless you have a marketing team (in-house or outsourced) that focuses on your audience, you risk being out of touch with the language (and keywords) your potential customers actually use to frame their pain points and challenges.

In other words, you’ll end up producing a lot of content that’s about you, instead of about your audience.

So, go back to those buyer personas. Do more keyword research that focuses on searcher intent. Create rich, genuinely helpful content around audience-focused topics. Then promote the heck out of that content via email, social, and PPC while you wait for the search algorithms to catch on.

Protip: Video is content marketing gold

When you create your content marketing plan, don’t forget video. We love video for fintech marketing for a few reasons:

- As a whole, the industry is behind the curve on video, so you can leave your competition in the dust.

- Video is extremely effective (and cost-effective) in pay-per-click campaigns.

- Video wins the day when it comes to engagement and conversions.

- According to Wyzowl’s 2022 State of Video Marketing Report, 87% of video marketers report a positive return on investment (ROI) from their video efforts.

Our fintech clients have seen success with video that helps customers solve specific problems via their offering, as well as with relatable video case studies that build trust.

7. Develop channels for low-friction customer interactions.

Hey, you’re in fintech — you’re all about building intuitive tech-enabled user experiences. Why not apply the same expertise to your digital marketing strategy? You can do it by baking in multiple opportunities for customers to interact with your brand long before they’re ready to schedule that call with sales.

Here are a few ideas to get you started:

- Use live chat or a chatbot on your website. This lets you ease your visitors into interacting with you. Wait until the third or fourth exchange to ask them for their email address and other information.

- Follow call-to-action (CTA) design best practices. Your “Contact Us” button should be prominent on every page of your website (we like it in the header), and it should use a shape and color that makes it both super noticeable and obviously clickable.

- Build up your FAQs. Give your audience plenty of material to answer their questions if they’re not ready to click that “Contact Us” button. Include a form for them to submit their own questions, which you can add to your FAQs and use as inspiration for content marketing.

- Design your forms to be as low-friction as possible. This means keeping the information you require to a minimum, and/or using gravity forms that expand as users complete fields. (And stay away from “Submit” as a CTA. No one wants to submit. “Send Message” is a better option.)

- Stay active on the social channels where your customers hang out. Monitor your comments and messages. Use auto-reply functions to keep response time as low as possible — and be sure to follow up with a customized reply as soon as possible.

8. Nurture leads with automated email campaigns.

Pretty much everything I’ve written so far boils down to one main goal: getting qualified leads. So let’s suppose you’ve built a world-class brand and an enterprise-ready website. Your SEO and content marketing efforts are driving traffic and conversions. Your PPC campaigns are firing on all cylinders. Your chatbot is busy answering questions and collecting email addresses.

Now — what are you going to do with all those leads?

Some are ready to be passed on to sales. (Cue the balloons!)

But most are marketing qualified leads (MQLs), meaning they need more warming up before they’re ready for primetime. That’s where automated email lead nurture campaigns come in. When crafting your lead nurture flow, ask yourself:

- What’s the source of the lead?

- Given the source, what stage of the buyer’s journey is your lead currently at?

- What questions does your lead need answered to move forward in their journey?

- How can you help your lead solve a problem or meet a goal?

- What content have you already created that answers those questions or solves those problems?

- What content do you need to create to fill in the holes?

Once you know the answers, create emails that drive your leads further down the funnel with every step.

Fair warning: this process can take a lot of trial and error at the start. You’ll want to A/B test everything about your emails, including their subject line, copy, design, and any resources or other CTAs. If you want a short cut, consider working with an agency that has experience crafting lead-nurture email campaigns for fintech companies like yours.

Want help launching a comprehensive digital marketing strategy for your fintech brand?

See that chatbot widget to the right? That’s Zac Gregg, one of the co-founders of Vital and an all-around good guy. Zac is incredibly generous with his knowledge. You’d be amazed by how much free advice he gives away to potential clients. (That’s kind of how we do things around here.) Feel free to send Zac a direct message using that chatbot — he’ll get back to you within 24 hours.

Already close the chat widget? No worries. Contact us here to start the conversation about your digital marketing challenges and goals.